The Impact of Gambling Taxes on Casino Work

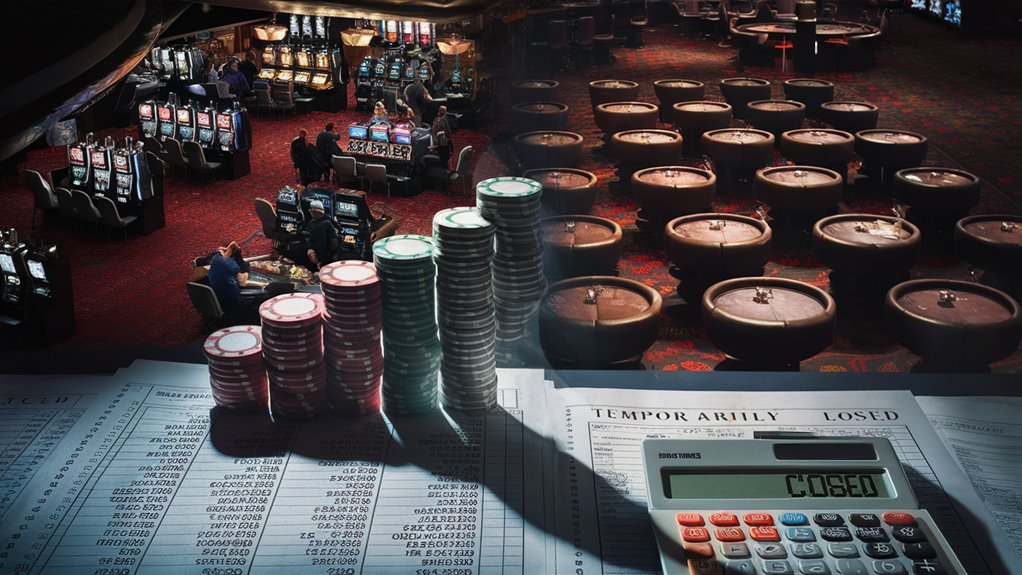

Casino taxes deeply affect how the gaming world runs and the big choices made in many areas. Tax rates from 6.75% to 50% of all money made from games (GGR) bring big work troubles for casino operators.

Money Impact on Casino Work

In places with high taxes, casinos see cuts in profit of 6-8%, pushing the need for smart changes to keep going strong. The clear link between tax rates and how well they work shows as money for ads falls by 12-15% with high taxes. Most of all, when taxes on games go over 35% of GGR, operators cut their spending on new projects by up to 32%. 온카스터디

Changes in How Casinos Work

These tax troubles lead to big changes in how things run:

- Less spots for table games by 18%

- Fewer non-game perks

- Less spending by 3-4% for every 5% rise in tax

The reach of gaming taxes goes far, changing how casino firms model their business, stay strong in the market, and plan for the future in the gaming zone.

Getting to Know Casino Tax Setups

Knowing the Layers of Casino Tax: A Full Look

State Gaming Tax Ways

Casino taxes work with many layers of government watch, making a complex net that hits casino work hard. State gaming tax rates show big changes across the U.S., from 6.75% to 50% of GGR. Nevada has the smallest rate, while Pennsylvania has the top rate.

Different Tax Systems and Money Parts

Most areas use tiered tax systems where money levels set the rates. A first pick is Illinois, using a scale from 15% to 50% based on set money marks. This layered way hits how casinos make money and their game plans.

More Layers of Taxes

U.S. Wide Gaming Taxes

Casinos must deal with a 21% federal company tax rate, along with special taxes like the 0.25% bet tax on sports bets. These U.S.-wide needs are the base for all gaming spots.

City Gaming Taxes

Local gaming taxes add an extra 2-7% load, with some places putting extra fees based on:

- Number of slot games

- Spots for table games

- Total space for games

- Money from games each year

Looking at How Work Happens

The layers of tax make different work settings across areas. In places with high taxes of 40%, casinos must make $1.67 in money to keep $1 after tax. On the other hand, places with 6.75% tax need only $1.07 in money for the same net money. These gaps shape:

- What games they pick and mix

- Price plans

- Choices on big money spends

- How well they do against others

Sharing Money and Work Costs

Looking at Casino Money Sharing and Work Costs

Breaking Down Money Use

Modern casino work follows detailed plans for sharing money in many parts. A common casino uses 30-40% for work costs, 20-30% for gaming taxes, 15-20% for work pay, and 10-15% for ads and deals. What’s left covers debt costs, new projects, and profit areas.

Tax Impact on Work

Gaming tax rates touch all parts of casino work. Places with taxes over 40% change how they work, including cutting jobs by 12-15% and cutting ad money up to 25% to meet profit aims. Data says every 5% rise in gaming tax means a 3-4% drop in work spending.

Looking at Work Costs

Table games need more workers, using about 35% of game money unlike slot games taking 15% of work pay. This gap in costs shapes how resources are used and how they react to taxes. Places with high taxes lean more on electronic gaming options, using less work cost despite high first money needs.

Changes in Game Floor Plans

Today’s Casino Game Floor: Changes in Layout

Money-led Changes in Game Floors

Casino heads have changed their game floors a lot since 2019, making smart changes to keep good money coming. Places have fewer regular table game spots by 18% while growing electronic game areas by 24%, as they deal with tax pressures and work costs.

More Electronic Games

Electronic gaming gear (EGDs) now lead with 82% of floor money and use 65% of all space. Smart spots for high-earning slots in key spots are now common, with penny games making up 67% of all game spots.

More Electronic Table Games

Electronic table games (ETGs) have become key for money, making 89% of traditional table money with 41% less work cost per spot. This shift helps casinos keep making money while keeping work costs low.

Better Floor Plans

Gaming Zones

Putting in themed game areas makes special “areas” of like games, showing a big 31% jump in time on machine rates. This smart group plan helps keep players playing and using machines more.

Better Use of Space

More space from less seat space has improved, moving from 48″ to 42″ on average. This move lets for a 15% rise in game spots in the same floor area, making the most of money per square foot while keeping player comfort.

These smart floor changes help places keep good profit marks even with rising gaming taxes and work costs, setting new top marks for how game floors work.

Market Work Under Taxes

Market Fight Under Casino Gaming Taxes

How Tax Rates Hit Casino Work

Rising gaming tax rates have changed how market fight works among casino places, making the need for smart moves to keep market share. Places in high-tax zones work with 6-8% smaller profit areas than low-tax spots, making a hard fight scene for making money.

Changes in Ads and Keeping Players

Casino places with taxes over 40% show a 12-15% fall in money for ads and deals. This big cut stops their power to pull and keep top players, who usually make 80% of game money. Smart loyalty plans have become key, with heads using data moves that focus on cost-per-get rates below $200 for top players.

More Merging in Markets

The tax-tight game market shows a 25% rise in merging moves, hitting small places’ power to last when gaming taxes go up by 5+ points. Places making money under $50 million each year face a 3.5 times bigger chance of being bought or shut when taxes rise. This market shift makes bigger scale work a must for lasting work, changing how market fight works across game zones.

Key Work Points

- Less profit: 6-8% in high-tax zones

- Less money for ads: 12-15% with high taxes

- Top player money: 80% of total game cash

- Cost to get top players: $200 each

- More merging: 25% increase in tough tax times

Money-making and New Spends

The Hit of Gaming Taxes on Casino Money-making and New Spends

Tax Rates and New Project Choices

Gaming tax rates deeply sway how casinos grow, with heads seeing a 32% cut in new spends when gaming taxes pass 35% of all game money. Money checks show that every 10% jump in gaming tax links with an 8.5% drop in new place builds and a 12% cut in place face-lifts.

Money Points and Market Work

EBITDA marks show a tight press of 15-20 points for each point rise in gaming taxes, hitting work life hard. Smart moves show 65% of new casino builds in areas keeping gaming taxes below 25%, showing the market’s answer to tax rules. Flicker & Fang Blackjack: Sinking Fleeting Tics With Splitting Predator Edge

Non-Game Money and Perks Impact

High-tax zones see big cuts in money put into non-game parts.

Places with high tax rules show:

- 45% less money in fun places

- Less new places to eat

- Fewer hotel updates

- An 18% fall in money not from games

These points show the full touch of tax rules on both game and extra money paths, shaping how casino spots fight and grow plans.